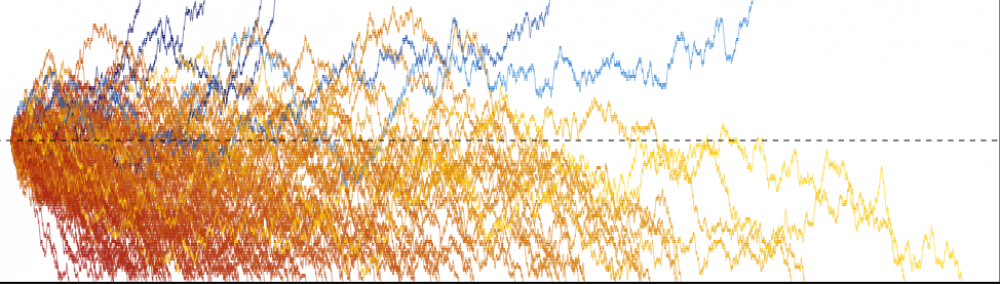

Value at Risk (VaR) is an important concept in finance and risk management that quantifies the risk on an investment or portfolio.

To define VaR, we need to fix two things: (i) the time horizon, and (ii) the probability of loss. For a time horizon and probability

. Value at Risk (VaR) fills in XX in the following statement:

Over the time horizon

, the probability that my investment will lose $XX (or XX%) or more is

.

Riskier investments will tend to have higher VaR.

Sometimes, instead of defining the probability of loss , we define the “level”

instead, where

. In that case, we might say

The VaR of this investment at level

over the time horizon

is $XX (or XX%).

Larger values of correspond to more and more unlikely scenarios, and so we expect VaR to increase as

increases.

The following diagram (taken from the Wikipedia article, Reference 1) illustrates how VaR relates to the probability distribution of investment value at the end of the time horizon. For 5% VaR (or equivalently VaR at level 0.95), we find the x-value such that the area under the curve on the left is exactly 5%. Since the distribution is depicting possible profits (larger values are better), 5% VaR would be the negative of the cutoff: Over the time horizon, there is a 5% probability that we will lose 0.82 or more.

Mathematically, VaR is simply a quantile of the appropriate distribution. If

Mathematically, VaR is simply a quantile of the appropriate distribution. If is the distribution of the loss (i.e. negative of the distribution above), then VaR at level

is the

-quantile of

.

There are several ways to compute/estimate VaR, see for e.g. Reference 2 from Investopedia.

References:

- Wikipedia. Value at risk.

- Investopedia. What is Value at Risk (VaR) and How to Calculate It?

Pingback: What is Conditional Value at Risk (CVaR)? | Statistical Odds & Ends

Pingback: CVaR and a lemma from Rockafellar & Uryasev | Statistical Odds & Ends